tax return unemployment covid

If you exclude unemployment compensation on your 2020 federal return as allowed under the American Rescue Plan Act of 2021 you must. Married couples can now take 25100 instead of 24800 last year and 1350 per spouse over 65.

Taxes Q A How Do I File If I Only Received Unemployment

This is a federal tax break and may not apply to state tax returns.

. DOR will adjust tax returns automatically for most taxpayers who meet the criteria for the unemployment deduction. Yes unemployment benefits received in 2021 are considered federally taxable income. VIDEO 148 0148 Initial jobless claims beat expectations near pre-Covid levels.

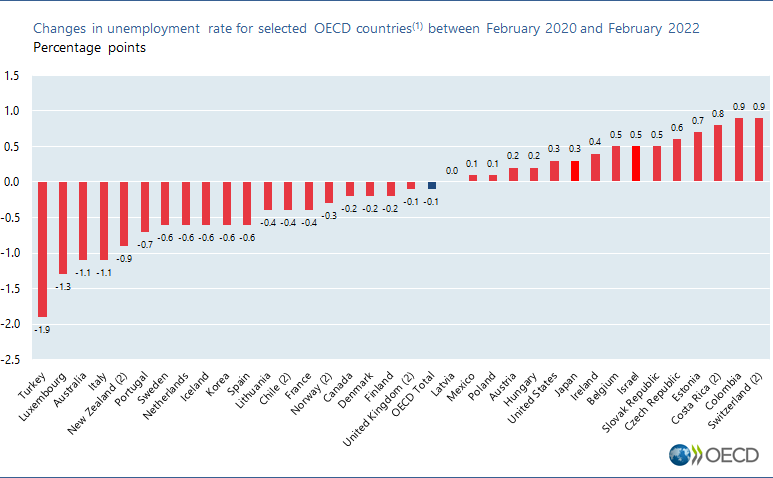

However unemployment is still well above pre. Always Free Federal Filing. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not.

COVID Tax Tip 2021-87 June 17 2021. Mark Heroux JD is a tax principal and leader of the Tax Advocacy and Controversy Services practice at Baker Tilly US LLP in Chicago. Why is the IRS issuing these special refunds.

Do not file an amended 2020 return before you hear from us. In the March 11th Covid-relief American Rescue Plan Congress made up to 10200 of 2020 unemployment benefits nontaxable for individuals and married. That number can be as much as 20400 for Married Filing Jointly taxpayers if each received benefits.

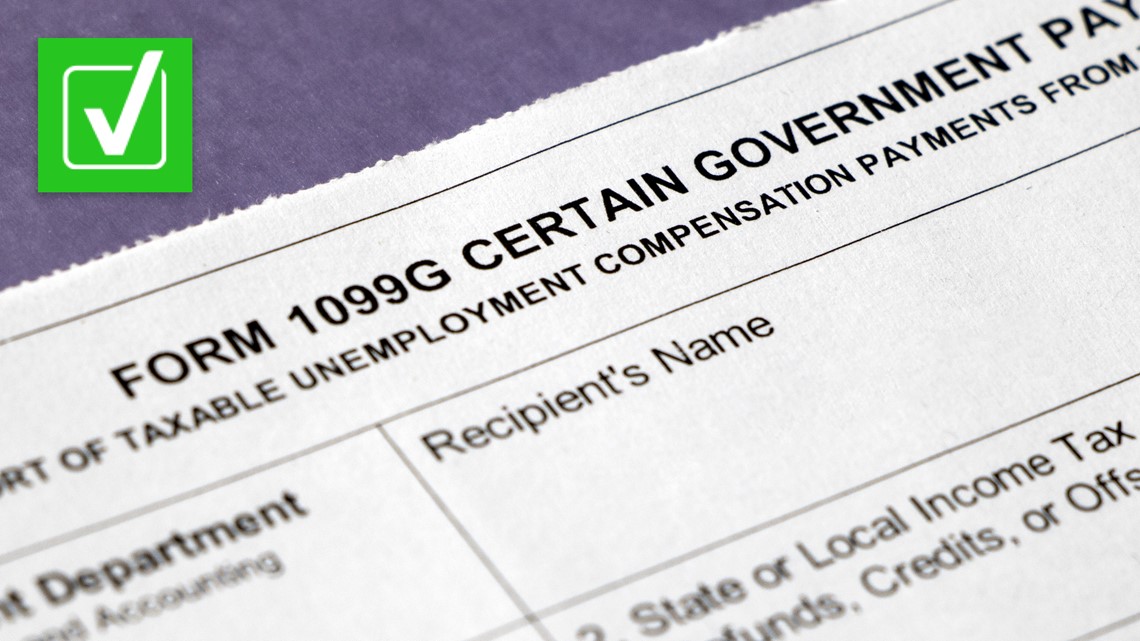

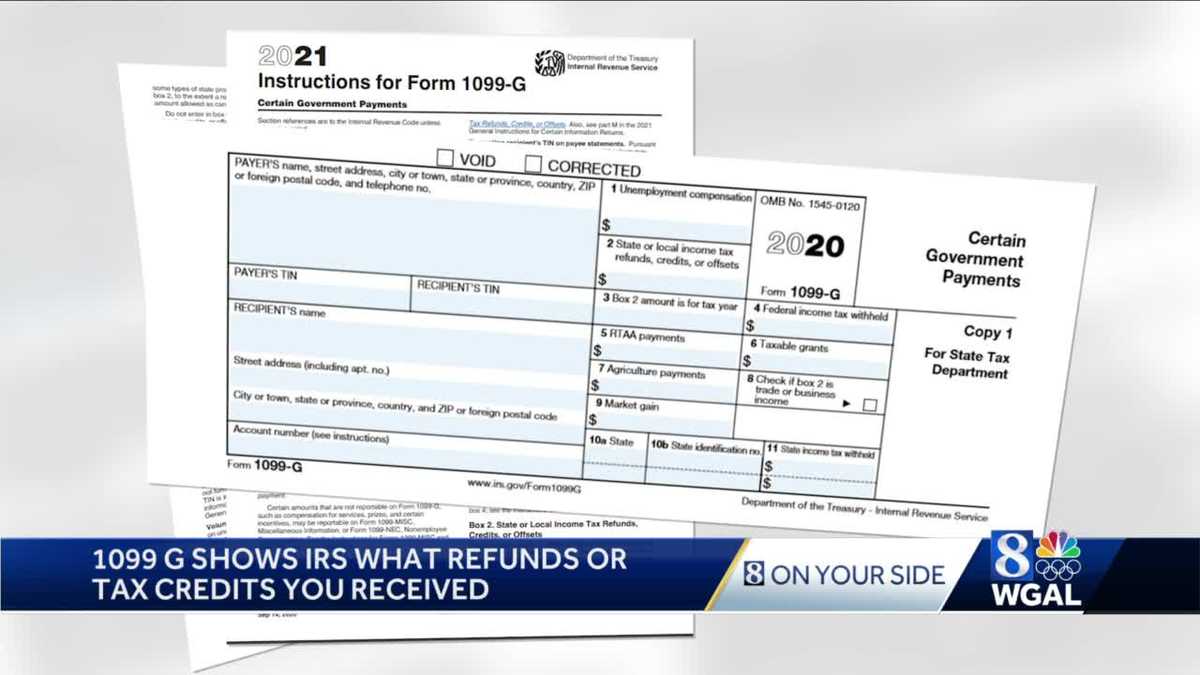

This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return. For taxpayers that file returns by paper because of the COVID. You should receive a Form 1099-G showing total unemployment compensation paid to you in 2020.

Each spouse is entitled to exclude up to 10200 of benefits from federal tax. Heres what else has changed. Pandemic-era relief laws have changed this temporarily.

In 2020 millions of Americans lost their jobs in the wake of the COVID-19 pandemic and claimed. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax.

As the title states I finally received a check in the mail for my 2020 amended return which I filed 8621. Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

Unemployment numbers surged at. Ad Free Federal Tax Filing. This story is part of Taxes 2022 CNETs coverage of the best tax software and everything else you need to get your return filed quickly accurately and on-time.

The additional 600 per week that the Coronavirus Aid Relief and Economic Security Act provides for qualifying state unemployment insurance beneficiaries is considered taxable income and it adds up fast. But that doesnt mean the couple as a tax unit always gets tax waived on double the amount 20400. Yes if your household income was not more than 200 of the federal poverty level you may deduct up to 10200 of unemployment benefits from your taxable income.

For example the extra 600 alone adds up to 9600 in income if you collect this additional benefit for a 16-week period. Does Massachusetts allow a deduction for unemployment income for tax years 2021. The federal tax filing deadline is April 15 2021 for your 2020 tax return.

How the Tax Filing Deadline Change May Affect the Self-Employed. DOR sent a communication to all taxpayers who filed a 2020 income tax return on or before April 9 2021 reporting unemployment income. This assistance covered unemployment benefits up to 10200 for households that made less than 150000.

E-File Directly to the IRS to Get Your Fastest Refund Possible. I report my business income on a personal income tax return. The newest COVID-19 relief bill the American Rescue Plan Act of 2021 waives federal taxes on up to 10200 of unemployment benefits an individual received in 2020.

The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. However while some taxpayers will file their 2020 federal and Ohio income tax returns and claim the unemployment benefits deduction the Department of Taxation is aware that many taxpayers filed and reported their unemployment benefits prior to the enactment of this deduction. THE DEADLINE PASSED BUT WE CAN STILL HELP.

Unemployment benefits at tax time. Unfortunately the unemployment tax break will not make a return for the 2021 tax filing season. People who become unemployed for the first time are often shocked to learn that they must report their unemployment benefits more than 10200 on their 2020 tax return.

Under longstanding New York State law unemployment compensation is subject to tax which means you should report the full amount of unemployment compensation on your New York State personal income tax return. COVID Tax Summary for Tax Year 2021. For additional information about these items contact Mr.

If you move and dont receive a 1099G from your. So keep in mind. Because Congress hasnt approved a similar tax break this year those expecting a refund.

The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. I have been checking transcripts and WMAR forever and finally about 2 wks ago they added my amended return on the transcript and and few days or so later I looked again and it gave me a date of 819 I checked my USPS informed delivery today and there she was a check. 20 hours agoThe Bottom Line.

The IRS increased the standard deduction for tax year 2021 filings to keep up with inflation. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. E-File your IRS Tax Return Today Get Your Maximum Refund.

The IRS is reviewing tax returns filed before the American Rescue Plan Act ARPA of 2021 became law in March 2021 to determine the correct taxable amount of unemployment compensation and tax. Both the Qualified Sick Leave and Qualified Family Leave tax credits have been made effective as of April 1 2020 and end March 31 2021 under the COVID-related Tax Relief Act of 2020. As the economy recalibrated in the wake of the COVID-19 pandemic unemployment numbers decreased in 2021.

In the latest batch of refunds announced in November however the average was 1189. As part of a continuing response to taxpayer issues with the COVID-19 pandemic the IRS is issuing penalty abatements refunds or credits for taxpayer and business tax returns. The IRS will continue the process in 2022 focusing on more complex tax returns.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Stimulus And Taxes How To Shield Up To 10 200 In Unemployment Benefits From Income Taxes Syracuse Com

Netherlands Covid 19 And The Labor Market

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Unemployment Rates Oecd Updated April 2022 Oecd

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

The Unemployment Impacts Of Covid 19 Lessons From The Great Recession

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

1099 G Tax Form Why It S Important

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Des Covid 19 Information For Individuals

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time