raleigh nc vehicle sales tax

About 8th Day Realty Group. Individual income tax refund inquiries.

Used Chevrolet Suburban For Sale In Raleigh Nc Edmunds

The raleigh north carolina general sales.

. 8th Day Realty Group 919 822-9800. The term Motor Vehicle includes automobiles trucks buses campers trailers and motorcycles. North Carolina residents who have not registered their.

Forums North Carolina Raleigh Durham Chapel Hill Cary. Kannapolis NC Sales Tax Rate. Mooresville NC Sales Tax Rate.

North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. Motor Vehicles are valued by year make and model in accordance with the North Carolina Vehicle Valuation Manual. Home Posts tagged Electric Vehicle Tax.

PO Box 25000 Raleigh NC 27640-0640. The Raleigh sales tax rate is. Raleigh NC Sales Tax Rate.

4 rows The current total local sales tax rate in Raleigh NC is 7250. New Bern NC Sales Tax Rate. Raleigh Nc Car Sales Tax.

Vehicles are also subject to property taxes which the NC. North Carolina property tax law requires counties to assess the value of motor vehicles registered with the NC. It is not intended to cover all provisions of the law or every taxpayers specific circumstances.

The City is required to pay North Carolina state and local sales taxes. Thank you for printing this page from the City of Raleighs Official Website wwwraleighncgov 09282021 1159 am Sales Tax. See reviews photos directions phone numbers and more for North Carolina Vehicle Tax locations in Raleigh NC.

This is the total of state county and city sales tax rates. Our purchase orders estimate these taxes. Monroe NC Sales Tax Rate.

Wake County Homes For Sale. Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect. Did South Dakota v.

In 2013 we were new to NC and had never dealt with vehicle tax. Raleigh Durham Chapel Hill Cary The Triangle Area. We leased a Hyundai Sonata.

This includes the sales tax rates on the state county city and special levels. 3 with a max of 475 And IIRC private party used vehicle sales pay the sales tax in AZ too. 2014 Electric Vehicle Tax North Carolina.

The 725 sales tax rate in Raleigh. 4 rows 025 lower than the maximum sales tax in NC. Roughly the same assessed value in our house but our RE taxes more than doubled.

The information included on this website is to be used only as a guide. What is the sales tax rate in Raleigh North Carolina. A motor vehicle offered for sale by a dealer to the end.

NC Vehicle Property Taxes Durham. This car registration thing is one of the few things that was a COL decrease when we moved from Phoenix to Raleigh. The County sales tax rate is.

The North Carolina sales tax rate is currently. Sales 2013 lease User Name. The City is required to pay North Carolina state and local sales taxes.

Our purchase orders estimate these taxes. North Carolina property tax law requires counties to assess the value of motor vehicles registered with the NC. Within Raleigh there are around 40 zip codes with the most populous zip code being 27610.

See reviews photos directions phone numbers and more for the best Used Car Dealers in Raleigh NC. The sales tax rate does not vary based on. Values are based on the retail level of trade for property tax purposes.

The average cumulative sales tax rate in Raleigh North Carolina is 725. However all applicable taxes should be included on your invoices. Sales and Use Tax Sales and Use Tax.

Salisbury NC Sales Tax Rate. North Carolina assesses a 3 percent sales tax on all vehicle purchases according to CarsDirect. As part of NCDMVs Tag Tax Together program the vehicle owner pays the property tax at the same time as the vehicles registration renewal fee.

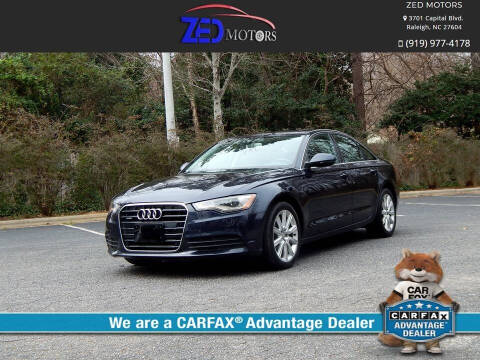

All vehicles are nc safety inspected with an available upon request car fax report. Thank you for printing this page from the City of Raleighs Official Website wwwraleighncgov 12052019 224 pm Sales Tax. Sales tax on purchase of a vehicle.

I Am The Resurrection And The Life Esv. New Life Recovery House. Rocky Mount NC Sales Tax Rate.

North Carolina Department of Revenue. This sales tax is known as the Highway Use Tax and it funds the improvement and maintenance of. Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina.

Jacksonville NC Sales Tax Rate. The minimum combined 2022 sales tax rate for Raleigh North Carolina is. City-Data Forum US.

Raleigh is located within Wake County North Carolina. Assessments apply to each transaction. Division of Motor Vehicles.

Nassau County Tax Grievance Deadline 2022. Wake Forest NC Sales Tax Rate. The December 2020 total.

However all applicable taxes should be included on your invoices. The 725 sales tax rate in Raleigh consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

Used Toyota Camry For Sale In Raleigh Nc Edmunds

Pin On Move From California To North Carolina

Used Gmc Acadia For Sale In Raleigh Nc Edmunds

Used Cars Under 5 000 For Sale In Raleigh Nc Vehicle Pricing Info Edmunds

Savaan Townes New Homes In Cary Nc Ashton Woods House In The Woods New Homes For Sale New Homes

Used Cars In Raleigh Nc For Sale

North Carolina Could Be Losing Millions From Unregistered Vehicles On The Road Abc11 Raleigh Durham

Multifamily Property Homes Apartment Buildings For Sale In Raleigh Nc Crexi Com

Cost Of Living In Raleigh Durham Nc Moving Com

Sales Tax On Cars And Vehicles In North Carolina

Cars For Sale In Raleigh Nc Zed Motors

Used Chevrolet Tahoe For Sale In Raleigh Nc Edmunds

Online Car Auctions Copart Raleigh North Carolina Repairable Salvage Cars For Sale